IMPORTANT: The Commonwealth of Massachusetts has changed the application process for emergency rental and mortgage assistance! Click here to learn more.

She rents. She buys. She soars! FSS graduate and new homeowner Shakina Gladden

To avoid certain disappointments, parents have been known to keep a thing or two from their kids until the last minute—tentative plans for a playdate, an outing that calls for good weather—in case things fall through. But purchasing a home? Shakina Gladden, of Springfield, did just that.

“I don’t want them to get excited if it’s not going to happen,” says Shakina, a mother of four and certified nursing assistant. “Because the house has to appraise. I’m keeping my fingers crossed. If it doesn’t, I have to start looking all over again.”

We recently had the chance to hear about Shakina’s path to homeownership—which was finalized on September 30, 2021. Her story could go by many descriptors: the hush-hush move, the no-move move, the best-friend move, the Sonia-inspired move.

Shakina began renting her Forest Park home nearly four years—to the day—before her closing date. She loves the flexibility of the three-bedroom home (“It has a dining room, so I use that as a bedroom, it’s perfect”). But on October 1, 2017, homeownership wasn’t on her radar.

Way Finders Program Specialist Sonia Colon helped change that. She mentors clients in the Family Self-Sufficiency (FSS) Program, which helps those receiving a Section 8 Housing Choice Voucher to achieve economic stability over the course of five years. This long-term approach to reaching goals revolves around supportive guidance. Sonia had a feeling that Shakina would be a great fit—specifically for the FSS Homeownership Program.

“Sonia called to invite me,” Shakina recalls. “She said we’d have meetings once or twice a month, with speakers. And we’d learn about credit, budgeting, planning. She made it sound really exciting.”

Also exciting? Taking part in the FSS Program with her best friend Shari Mendez. They attended meetings together, kept budget books together, and motivated one another. And, eventually, purchased their first homes within weeks of one another.

“If I want to buy something, Shari pops in my head first, saying, ‘Oh no, don’t you do that! You have to save the money. You’ve got to buy a house!’” Shakina says. “So, we were on each other like that.”

With her diligent attention to saving money, paired with a strategic approach to paying down debt, over the past few years Shakina was able to pay off her student loans (more than $10,000) and greatly improve her credit score. A tip she learned from Sonia that helped along the way: Establish a budget plan with the gas utility for a steady—instead of a fluctuating—monthly payment.

“Everything I tell her, she will do it,” Sonia says. “All the advice and positive suggestions to improve her life, she listens. That’s why she did the program in only four years, she’s doing an early graduation.”

When Shakina looks back at her the early days of her budget book, she marvels at her progress, too. “Oh, my gosh, it’s so much better now.”

With progress and support came the confidence to pursue more—which Shakina instilled in her oldest daughter, who purchased a home in November 2020. As Shakina herself looked at what felt like “a million houses,” she had a solid point of reference: the home she was renting. “In my head, I’m like, ‘OK, I need a house like this.’ Every house, I kind of compared it to where we were at, size wise.”

After disappointments began to pile up—Shakina suspects she lost out to buyers who waived the inspection, which she knew never to do—she made a bold move.

“I asked my landlord, ‘Would you be willing to sell me your house?’ And his answer was ‘Yes and no,’” Shakina says. “Yes, because I’m a good tenant and it’s a good time to sell. No, because he wasn’t intending to sell.”

“I asked my landlord, ‘Would you be willing to sell me your house?’ And his answer was ‘Yes and no,’” Shakina says. “Yes, because I’m a good tenant and it’s a good time to sell. No, because he wasn’t intending to sell.”

Having learned his asking price, which was just out of reach, Shakina worked to further improve her credit and buying power. When she approached him a second time, his answer was “Yes.”

During the last leg of her journey, Shakina leaned on her support system (“I haven’t had any stress yet, knock on wood, but it helps to have someone like Sonia to talk to”). And she relies on her inner voice, too.

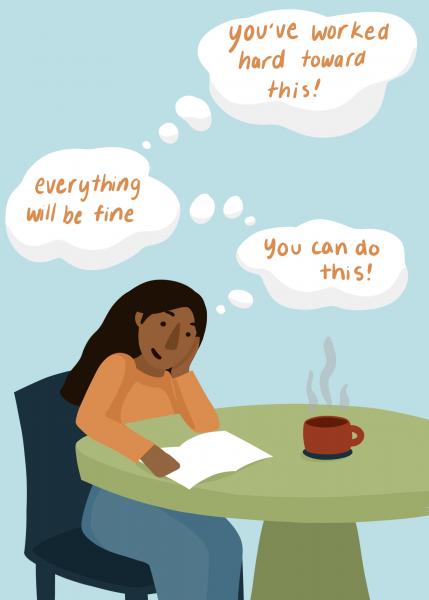

“The other day I was thinking, ‘I’m going to buy a house! What if something bad happens and I can’t pay?’” Shakina says, in response to how it feels to relinquish her voucher. “And I’m like, ‘No, you’ll be fine. You’ve been working hard toward this. Keep putting everything you’ve learned into action.’”

“Right,” Sonia adds. “As long as you keep that motivation, there’s nothing to worry about.”

Having now assumed ownership of their home—and spilled the beans to her kids—Shakina speaks of the FSS Program with gratitude. “It has impacted me in a very good way. I’ve learned how to manage life, manage bills, manage stress. So, I’m in a better place, and my kids are in a better place because of it.”

Congratulations, Shakina!

Illustrations by Marcy Paredes

Illustrations by Marcy Paredes