With a data assist from Way Finders, Florence Bank creates a new program to boost access to homeownership in Chicopee, Holyoke, and Springfield

Housing advocacy doesn’t just happen at the state and macro levels. It also happens closer to home—at town meetings, planning board meetings, and public hearings on zoning. Add to that list local banks, according to Florence Bank’s Senior Vice President and Chief Credit Risk Officer Barbara-Jean DeLoria.

When Florence Bank set out in early 2025 to create a new product for first-time homebuyers—in addition to the suite of existing products available to those buying their first home—they did a lot of listening. Where were people struggling to buy, and why?

“We spent a lot of time in the community talking to nonprofits, realtors, attorneys, everyone. To really find out what barriers to homeownership are truly out there,” said DeLoria, who joined Florence Bank in 2014 and manages the residential mortgage division, loan servicing, collections, and the commercial credit department. “Part of our mission, which is really important to us, is to build and strengthen the communities we serve. And homeownership helps people build equity and generational wealth.”

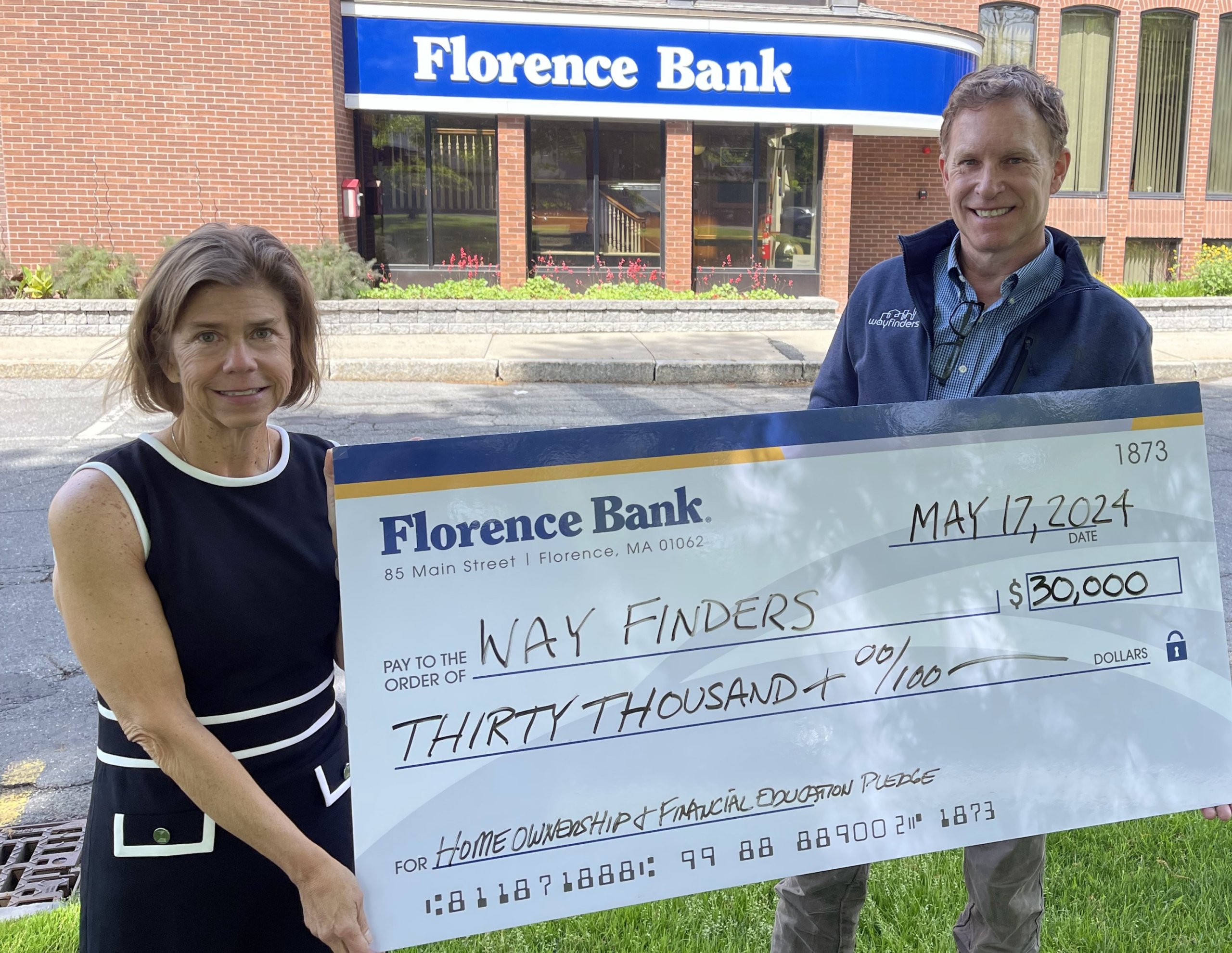

At left, Barbara-Jean DeLoria of Florence Bank with John Bidwell of Way Finders.

The down payment, DeLoria and her colleagues learned, is one of the biggest barriers people face. “People want to save and are trying to save. But they’re also paying rent, childcare, and student loans. And look at the cost of living. A lot of individuals have good credit, and the amount they’re paying in rent may be pretty similar to what they’d pay monthly for their first home.”

Plus, those who aren’t able to save up a sizeable down payment typically face an additional barrier: private mortgage insurance, a costly requirement for those who put less than 20% down.

The new product that Florence Bank began offering in mid-2025—the Welcome Home First-time Homebuyer Program—removes both barriers for those looking to buy an owner-occupied home (single family, two family, or condo) in Chicopee, Holyoke, and Springfield. Yes, you read that right!

Beyond offering 100% financing and charging no private mortgage insurance, the program also offers a reduced mortgage interest rate and waives the $950 mortgage processing fee. There are no income restrictions, and borrowers receive an additional lender credit of $1,000. If the property is in a Majority Minority Census Tract (as defined by the U.S. Census Bureau), borrowers receive an additional lender credit of $10,000. There is also a dedicated staff person—Community Loan Originator Paola Sherman—who serves the area’s Spanish-speaking community.

“Most people, when we start talking to them about the Welcome Home Program, or if we’re talking to a realtor, they’re like, ‘This is too good to be to be true. What’s the catch?’” said DeLoria, who emphasizes that there isn’t any catch. “If someone has good income and established credit, there’s a way for them to get into a house without putting any money into it. I’ve been in banking for a long time, and I’m so excited about this because it really covers a lot of bases when it comes to creating access to homeownership.”

In early 2025, as DeLoria and other members of the bank’s senior leadership team began brainstorming the ideas that grew into the program, they faced a barrier of their own.

“As we were working with our legal counsel and receiving guidance to put this product into place, everyone kept saying to us, ‘Where’s your data? Where are your data points to support your gut instincts and what you’ve heard by word of mouth, about why people have long struggled to buy in these areas?’” said DeLoria. “As a bank, we have regulators and fair lending regulations we must meet. So we had to be very careful to come up with a product that was within compliance.”

For this essential validation, Florence Bank turned to Way Finders: “Our compliance team reached out to Way Finders and said, ‘Can you help us get documentation to help us prove our product is what’s needed in these communities?’” said DeLoria. “Way Finders has access to so many different data sources, which really helped support our effort to create this program.”

Way Finders shared relevant data from its 2021 and 2022 regional housing studies—including homeownership rates and housing cost burden by race, homeowner vacancy rates, and areas in the region with the lowest homeownership rates—in addition to data from MassINC’s 2024 Gateway Cities Housing Monitor. The information helped Florence Bank target the program’s service area of Chicopee, Holyoke, and Springfield, which stood out in the data as areas where homeownership rates could be boosted and better supported.

“We are so grateful to have partners such as Way Finders. The more we can collaborate and share resources and outreach, the more we can do great things. It takes a village,” said DeLoria, who served on the Regional Housing Study Advisory Committee for Way Finders’ 2025 regional housing study. “I truly believe this program is helping us serve our mission by helping us really focus on getting people into homes. Not everyone has generational wealth or financial help from family. This program is a quicker path to building equity and generational wealth.”

Way Finders is proud to count Barbara-Jean DeLoria and Florence Bank among our partners and supporters. Thank you!